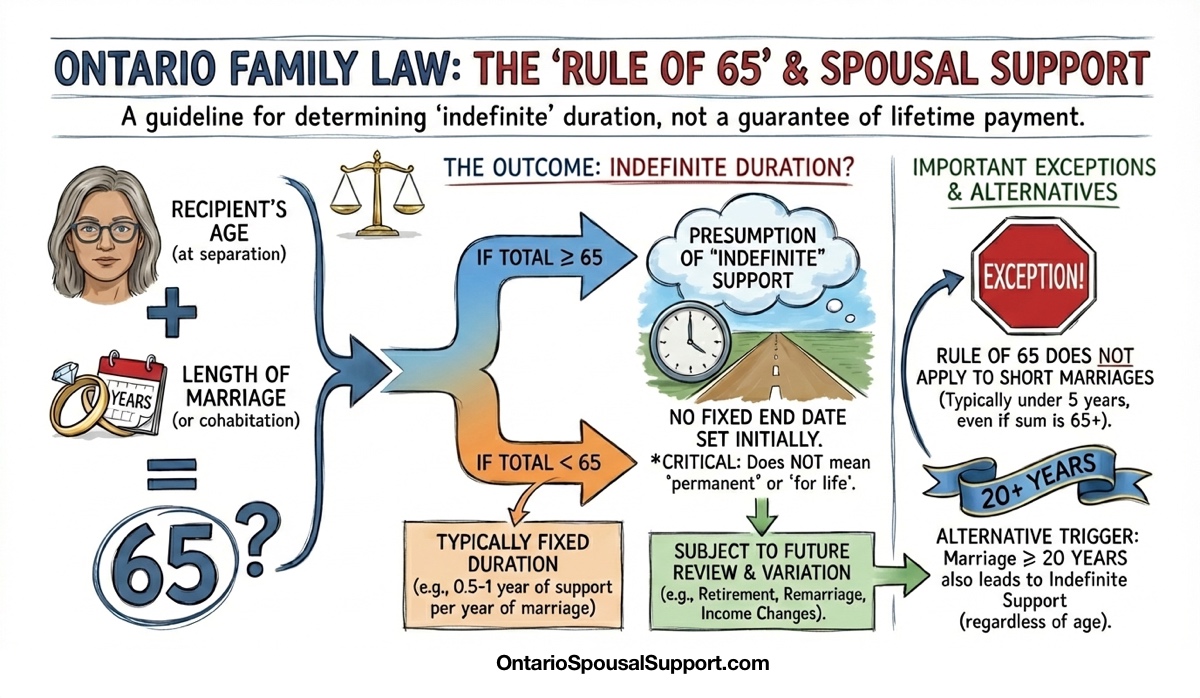

Add your age plus the years you were married. If that number is 65 or higher, you might be paying—or receiving—spousal support indefinitely.

Not "for a few years." Not "until they get back on their feet." Indefinitely.

That's the Rule of 65. And it blindsides people every single day.

The Rule of 65 in 30 Seconds

The formula: Recipient's age at separation + years of marriage = 65 or more

The requirement: Marriage must be at least 5 years long (for 20+ years long marriage rule might be applied regardless)

The result: Spousal support has no automatic end date

The catch: "Indefinite" doesn't mean "forever"—but it's close enough to feel that way

What the Rule of 65 Actually Is

The Rule of 65 comes from the Spousal Support Advisory Guidelines (SSAG)—the formula Ontario courts use to calculate support. It's not a law. It's a guideline. But judges use it in roughly 90% of cases, so it's about as close to "the rule" as you're going to get.

Here's the logic behind it: When someone leaves a long marriage later in life, their ability to become financially independent is seriously compromised. They're not 30 anymore. They can't just "start over." The job market isn't kind to 55-year-olds who've been out of the workforce for two decades.

So the SSAG says: if the recipient's age plus the years of marriage equals 65 or more, we're not going to pretend they'll magically become self-sufficient. Support duration becomes indefinite.

How to Calculate If the Rule of 65 Applies to You

The math is simple. The implications are not.

Step 1: Take the age of the lower-earning spouse (the one who would receive support) at the date of separation.

Step 2: Add the number of years you were married or living together.

Step 3: If the total is 65 or more, and you were together at least 5 years, the Rule of 65 applies.

Example 1: Classic Rule of 65 Case

Sarah is 52 when she separates. She was married for 18 years.

52 + 18 = 70

The Rule of 65 applies. Support duration is indefinite.

Example 2: Just Under the Threshold

Mike is 45 when he separates after a 15-year marriage.

45 + 15 = 60

The Rule of 65 does NOT apply. Mike gets time-limited support (7.5 to 15 years based on the standard formula).

Example 3: Later Marriage, Shorter Duration

Jennifer married at 50 and is separating at 60 after 10 years.

60 + 10 = 70

Even though it was "only" a 10-year marriage, the Rule of 65 applies. Support is indefinite.

The Two Triggers for Indefinite Support

The Rule of 65 isn't the only way support becomes indefinite. There are actually two triggers:

Trigger 1: The Rule of 65

Age + years married = 65 or more (with at least 5 years of marriage)

Trigger 2: The 20-Year Rule

If you were married 20 years or longer, support is indefinite regardless of age.

So if you got married at 25 and separated at 45 after a 20-year marriage, your age plus years (45 + 20 = 65) hits the Rule of 65 anyway. But even if you were younger—say, married at 20, separated at 40—the 20-year rule kicks in independently.

What "Indefinite" Actually Means (It's Not Forever—But It's Close)

Here's where people get confused. "Indefinite" doesn't technically mean "forever." It means no automatic end date.

The difference matters legally. Practically? It often doesn't.

What indefinite means:

- The court order or agreement doesn't include a specific end date

- Support continues until something changes

- If you want it to stop, you have to go back to court or renegotiate

What indefinite doesn't mean:

- It doesn't mean the amount can never change

- It doesn't mean you can't ever apply to terminate it

- It doesn't mean it automatically lasts until death

But here's the practical reality: getting indefinite support terminated is hard. You need to show a "material change in circumstances." And even then, courts are often reluctant to cut off someone who's been receiving support for years and has built their life around it.

When Indefinite Support Can Actually End

Indefinite doesn't mean untouchable. Here are the situations where support can be reduced or terminated:

1. The Recipient Becomes Self-Sufficient

If the recipient gets a good job, inherits money, or otherwise achieves financial independence, the payor can apply to reduce or end support. But "self-sufficient" is a high bar. Getting a part-time job usually isn't enough.

2. The Recipient Remarries or Cohabits

Unlike child support, spousal support can be affected by the recipient's new relationship. Remarriage doesn't automatically end support, but it's often grounds for variation. Living with a new partner in a marriage-like relationship can have similar effects.

3. The Payor Retires

When the payor reaches retirement age and their income drops significantly, they can apply to reduce support. Courts generally recognize that you can't pay the same amount on a pension that you paid on a working salary.

4. Significant Health Changes

If the payor becomes seriously ill or disabled and can no longer work, or if the recipient's health improves dramatically, these can be grounds for variation.

5. Lottery Wins and Windfalls

If the recipient comes into significant money through inheritance, lottery, or other windfall, the payor can argue their need for support has decreased.

The 5-Year Minimum: A Small But Important Detail

The Rule of 65 has a built-in safety valve: it only applies if the marriage lasted at least 5 years.

This prevents absurd outcomes. Without this rule, a 64-year-old who marries someone for 2 years would trigger indefinite support (64 + 2 = 66). That's not what the rule is designed for.

So if you were married less than 5 years, the Rule of 65 doesn't apply—no matter how old the recipient is. Normal duration rules (0.5 to 1 year of support per year of marriage) apply instead.

Does the Rule of 65 Apply to Common-Law Couples?

Yes. The SSAG applies to both married couples and common-law partners in Ontario.

The calculation uses years of cohabitation, not just legal marriage. If you lived together for 12 years and the recipient is 55 at separation, that's 67—Rule of 65 applies.

Common-law couples often think they're exempt from spousal support entirely. They're not. If you meet the criteria under Ontario's Family Law Act (lived together for at least 3 years, or have a child together), spousal support rules apply—including the Rule of 65.

Can You Avoid the Rule of 65?

Let's be honest: if you clearly meet the criteria, you're probably not avoiding it.

The SSAG is a guideline, not a law. Courts have discretion to depart from it. But they rarely do without good reason. If the math says Rule of 65 applies, that's usually what happens.

Factors that might lead a court to depart from the Rule of 65:

- The recipient has strong earning potential and just hasn't pursued it

- The recipient has significant assets that reduce their need

- The recipient refused reasonable efforts to become self-sufficient

- There was a very short separation after a long marriage (reconciliation attempts)

- Exceptional circumstances that make indefinite support clearly unfair

But these are exceptions. If you're 55, were married for 15 years, and your spouse earned significantly less, you should plan for indefinite support. Hoping for an exception isn't a strategy.

What This Means For Your Life

Let's translate the legal stuff into real impact.

If You're the Payor:

- Retirement planning gets complicated. You need to factor ongoing support payments into your retirement budget. Can you afford to retire when you planned?

- Your income is partially committed—potentially for decades. That affects your ability to buy a house, save, or start over financially.

- You'll need to budget for potential legal fees. If circumstances change and you want to vary support, you'll be back in court.

If You're the Recipient:

- Don't assume it lasts forever. Build skills, maintain employability if possible. The payor will eventually retire, and support will likely decrease.

- Remarriage or cohabitation has consequences. A new relationship could affect your support. Make informed decisions.

- Indefinite doesn't mean guaranteed. Your ex can always apply to vary. Keep records, stay informed about your rights.

The Strategic Timing Question

Here's something no one talks about openly: the timing of your separation matters.

The Rule of 65 is calculated at the date of separation—not the date of divorce, not the date you file paperwork. The date you actually separate.

This creates some uncomfortable strategic realities:

- If you're 55 + 9 years of marriage = 64, waiting one more year means the Rule of 65 kicks in

- If you're the potential payor and you're close to the threshold, separating sooner rather than later could mean time-limited instead of indefinite support

- If you're the potential recipient and you're close, waiting could mean the difference between support that ends and support that doesn't

I'm not telling you to manipulate the timing of your separation. Marriages end when they end. But you should know how the math works before you make decisions.

Try the Calculator

Want to see how spousal support might work in your situation? Our calculator uses the actual SSAG formulas—including the Rule of 65 for duration.

The calculator will show you the amount range and tell you whether support would be time-limited or indefinite based on your inputs. It's a starting point—not a guarantee—but it's a lot better than guessing.

Frequently Asked Questions

What is the Rule of 65 for spousal support in Ontario?

The Rule of 65 is a formula in the Spousal Support Advisory Guidelines (SSAG). Add the support recipient's age at separation plus the years of marriage. If that number equals 65 or more, and the marriage lasted at least 5 years, spousal support may be ordered indefinitely—meaning no set end date.

Does indefinite spousal support mean I pay forever?

No. "Indefinite" doesn't mean "forever." It means there's no automatic end date built into the order. Support can still be reduced or terminated if circumstances change—like the recipient becoming self-sufficient, remarrying, or the payor retiring. But you'll need to go back to court or renegotiate to make changes.

Can I avoid the Rule of 65?

The Rule of 65 is a guideline, not a law. Courts have discretion to depart from it in specific circumstances. Factors like the recipient's ability to become self-sufficient, health issues, or significant changes in circumstances can affect the outcome. However, if you clearly meet the criteria, courts typically follow the guideline.

What triggers indefinite spousal support in Ontario?

Two main triggers: (1) The Rule of 65—if the recipient's age plus years married equals 65 or more (with at least a 5-year marriage), or (2) A marriage of 20 years or longer, regardless of age. Either trigger can result in indefinite support duration.

How is the Rule of 65 calculated?

Take the age of the lower-earning spouse (the potential support recipient) at the date of separation. Add the number of years you were married or living together. If the total is 65 or more, and you were together at least 5 years, the Rule of 65 applies. Example: Age 52 + 15 years married = 67. Rule of 65 applies.

Does the Rule of 65 apply to common-law couples?

Yes. The SSAG and the Rule of 65 apply to both married couples and common-law partners. The calculation uses years of cohabitation, not just legal marriage. If you lived together for 12 years and the recipient is 55 at separation, that's 67—Rule of 65 applies.